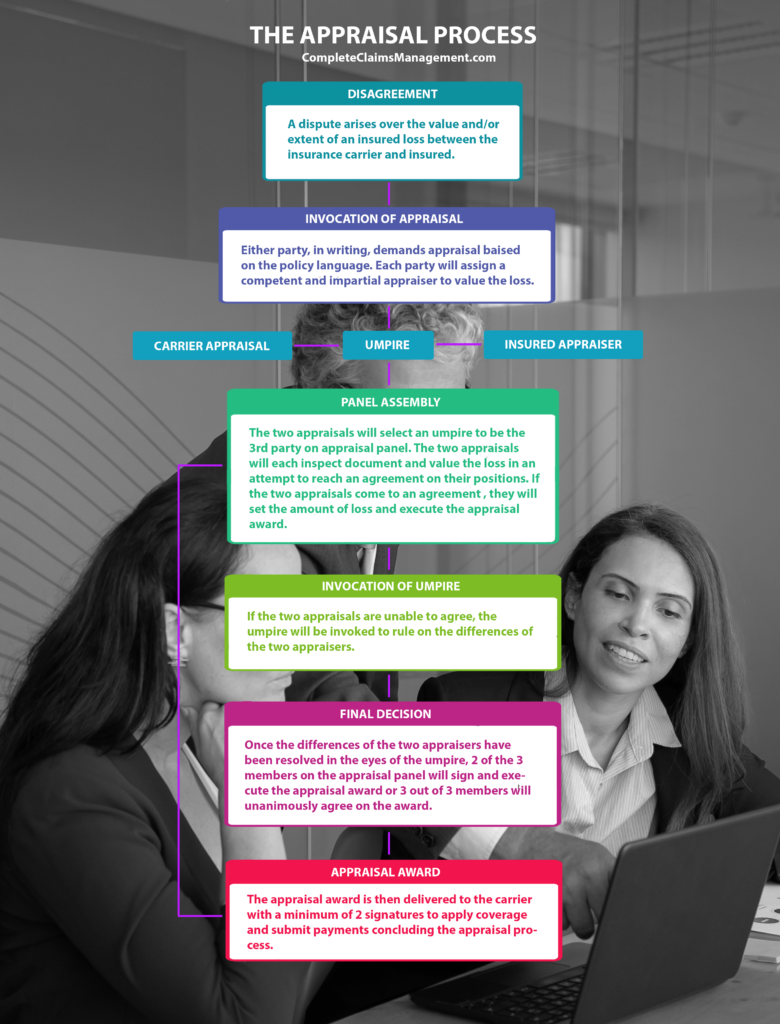

1. Disagreement

A dispute arises over the value and/or extent of an insured loss between the insurance carrier and insured.

2. Invocation of Appraisal

Either party, in writing, demands appraisal based on the policy language. Each party will assign a competent and impartial appraiser to value the loss.

3. Panel Assembly

The two appraisers will select an umpire to be the 3rd party on the appraisal panel. The two appraisers will each inspect, document and value the loss in an attempt to reach an agreement on their positions. If the two appraisers come to an agreement, they will set the amount of loss and execute the appraisal award.

4. Invocation of Umpire

If the two appraisers are unable to agree, the umpire will be invoked to rule on the differences of the two appraisers.

5. Final Decision

Once the differences of the two appraisers have been resolved in the eyes of the umpire, 2 of the 3 members on the appraisal panel will sign and execute the appraisal award OR 3 out of 3 members will unanimously agree on the award.

6. Appraisal Award

The appraisal award is then delivered to the carrier with a minimum of 2 signatures to apply coverage and submit payments concluding the appraisal process.

20+ YEARS

OF EXPERIENCE

For more than 20 years, Complete Claims Management has provided construction consulting services that top builders have used to increase profits and expand their range of productivity. We know the ins and outs of construction like no one else, and our knowledge can make the difference between a successful project and a costly one. Our innovative, streamlined process will efficiently build and close out your jobs, while maximizing your returns. We can help you meet and exceed homeowner expectations, leaving you free to focus on your company’s growth.